Author: Euler Labs

Date: 2025-06-20

Summary

Euler is officially deploying on Arbitrum Mainnet. The Euler Prime market on Arbitrum will establish dedicated lending and borrowing facilities for blue chip assets to facilitate common trades like blue chip lending, stablecoin borrowing, and LST/LRT looping. This market positions Euler as a key competitor in the lending landscape on Arbitrum.

Specification

New Assets

- Borrowable Assets: USDC, USDT0, WETH, wstETH, weETH, WBTC, ARB

Risk Management

Euler Arbitrum will be governed by Euler DAO and risk-managed by Gauntlet and Objective Labs. Euler Labs invites Gauntlet and Objective Labs to provide initial recommendations for risk parameters for the Euler Arbitrum market.

Copyright

Copyright and related rights waived via CC0.

1 Like

Objective Labs: Initial Risk Recommendations for Euler Arbitrum market

Liquidation Loan-to-value Ratios (LLTVs)

Collateral on rows, debt on columns.

| Asset |

USDC |

USDT0 |

WETH |

wstETH |

weETH |

WBTC |

ARB |

| USDC |

0.00 |

0.96 |

0.86 |

0.84 |

0.84 |

0.86 |

0.65 |

| USDT0 |

0.96 |

0.00 |

0.86 |

0.84 |

0.84 |

0.86 |

0.65 |

| WETH |

0.86 |

0.86 |

0.00 |

0.95 |

0.94 |

0.86 |

0.65 |

| wstETH |

0.84 |

0.84 |

0.95 |

0.00 |

0.93 |

0.84 |

0.65 |

| weETH |

0.83 |

0.83 |

0.94 |

0.93 |

0.00 |

0.83 |

0.65 |

| WBTC |

0.86 |

0.86 |

0.86 |

0.84 |

0.84 |

0.00 |

0.65 |

| ARB |

0.65 |

0.65 |

0.65 |

0.65 |

0.65 |

0.65 |

0.00 |

Caps

All amounts are in units of the underlying.

| Asset |

Supply cap (unit) |

Borrow cap (unit) |

| USDC |

100,000,000 |

90,000,000 |

| USDT |

100,000,000 |

90,000,000 |

| WETH |

50,000 |

45,000 |

| wstETH |

30,000 |

15,000 |

| weETH |

30,000 |

15,000 |

| WBTC |

1,000 |

900 |

| ARB |

10,000,000 |

8,000,000 |

IRMs

All rates are borrow APY.

| Asset |

Base rate |

Kink |

Rate at kink |

Rate at 100% (max) |

| USDC, USDT0 |

0% |

90% |

6% |

40% |

| WETH |

0% |

90% |

2.7% |

40% |

| wstETH, weETH |

0% |

50% |

1% |

40% |

| WBTC |

0% |

90% |

1% |

40% |

| ARB |

0% |

80% |

5% |

80% |

We recommend that the interest fee remain at the default value of 10%.

Oracles

In line with best practices we recommend market price oracles for USDC, USDT0, WETH, and ARB, and fundamental oracles for wstETH, weETH, and WBTC.

1 Like

Gauntlet has reviewed Objective Labs’ proposed risk parameters for the upcoming Arbitrum Prime market and is fully aligned with their recommendations.

Regarding the LLTV Matrix, Supply/Borrow Caps, IRMs, and Oracles, we find the suggested metrics appropriate for launch.

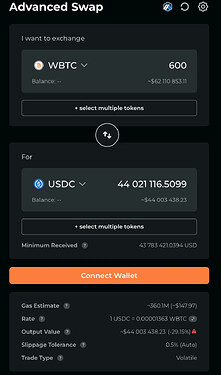

One recommended update we suggest is the WBTC supply and borrow caps. WBTC liquidity pools have been volatile during our review (swaps ranging from 15% to 30% simulating a 600 WBTC trade), see below. We recommend reducing caps to the following:

| Asset |

Supply Cap |

Borrow Cap |

| WBTC |

600 |

540 |

Once the Prime markets are live, Gauntlet will actively monitor utilization, liquidity conditions, and market-wide volatility. Where data indicates updates are warranted, we will propose adjustments via the Cap Steward.

1 Like