- Title: Promote wstETH to collateral tier

- Author(s): Seraphim Czecker

- Submission Date: 04.05.2022

eIP 11: Promote wstETH to collateral tier

Simple Summary

Proposal includes a batch of changes to the wrapped Lido Staked ETH token (wstETH) on Euler. These include: promotion of wstETH to the collateral tier. Increase of wstETH collateral factor to 0.85. Increase of wstETH borrow factor to 0.89. Enable cross borrowing. Amend the interest rate model. Reduce reserve factor to 0.10. Direct EUL reward gauges towards wstETH.

Abstract

This is a proposal to promote wstETH to the collateral tier on Euler, enabling Euler users to borrow against it. wstETH fits the collateral eligibility criteria of a collateral asset. It is backed by a robust oracle on Uniswap v3. It is widely distributed and decentralised. It has very high liquidity on numerous decentralised exchanges. Smart contract risk is relatively low. On the upside, adding a new collateral asset to the protocol would increase capital efficiency and provide more utility for users. On the downside, adding a new collateral asset always introduces a degree of systemic risk. In the case of wstETH, the benefits outweigh the potential risks.

The proposal also includes a simplification of the Gauges on offer from 13 in epoch 3 to 10 in epoch 4. The four gauges sacrificed to make way for a new wstETH gauge will be those distributing EUL least efficiently (by ‘mining rate’), since these are the gauges that are failing to decentralise the supply of EUL. They include: SHIB, MATIC, oSQTH, and ENS.

Motivation

The goal of the proposal is to create a vibrant market around stETH on Euler. The underlying features of the Euler protocol will allow DeFi users to efficiently lever up on staking rewards as well as hedge their stETH exposure using the shorting mechanism.

Promoting wstETH to collateral status with more competitive risk factors than the rest of the market will allow the DeFi community to utilise their balance sheet more efficiently.

Specification

1. What is the link between the eIP author and the asset?

None. The proposer is the head of risk at Euler Finance and has no link to wstETH.

2. Provide a brief description of the asset

wstETH is the wrapped version of stETH. stETH is a token that represents staked ether in Lido, combining the value of initial deposit + staking rewards. stETH tokens are minted upon deposit and burned when redeemed. stETH token balances are pegged 1:1 to the ethers that are staked by Lido. stETH token’s balances are updated when the oracle reports change in total stake every day.

3. How is the asset primarily used?

stETH is currently used to earn leveraged yield on Aave and is heavily used for LP fees on Curve.

4. Explain why the eIP would benefit Euler’s ecosystem?

Promoting wstETH to collateral status with more competitive risk factors than the rest of the market will allow Euler to increase its market share in the staked ETH industry.

5. Where does the asset trade?

stETH and wstETH are actively traded on Curve but also Balancer and Sushiswap. The Uniswap v3 market has started to grow recently as well.

Consequently, it would allow liquidators to relatively easily offload wstETH on DEXes in the event of a liquidation.

6. What are the volumes and market capitalisation?

Market capitalisation is $11 billion with $7 million traded in the last 24h.

7. What is the liquidity like in the Uniswap V3 liquidity pool versus ETH?

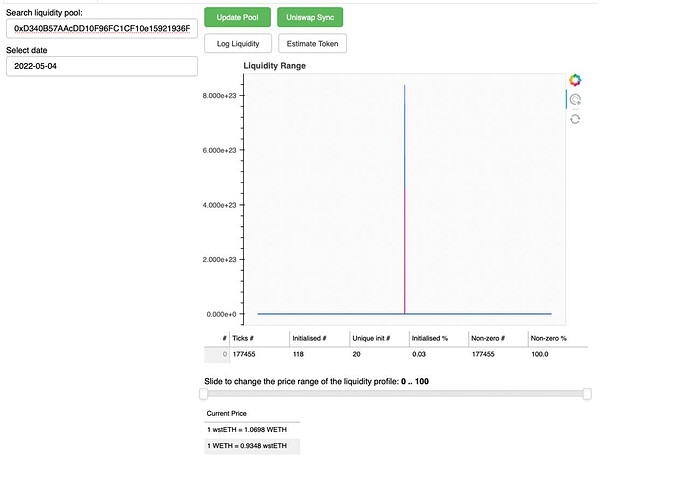

The 0.05% wstETH/WETH Uniswap V3 pool has been growing in terms of liquidity and has full-range liquidity. We see arbitrage activity from several protocols and traders, meaning the pool is watched for mispricings.

8. What security/auditing reports have been done?

Lido has been audited by Sigma Prime, Quantstamp and MixBytes.

Implementation

| Contract | Method | Token | Token Name | Token Address | Updates |

|---|---|---|---|---|---|

| governance | setAssetConfig | WSTETH | Wrapped stETH | 0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0 | borrowIsolated:false, collateralFactor:0.85, borrowFactor:0.89 |

| governance | setIRM | WSTETH | Wrapped stETH | 0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0 | IRM:MEGA |

| governance | setReserveFee | WSTETH | Wrapped stETH | 0x7f39c581f595b53c5cb19bd0b3f8da6c935e2ca0 | reserveFee:0.1 |

Risk Assessment

Oracle Grading

According to our inhouse research, meaningful attacks on the 0.05% wstETH/WETH Uniswap V3 oracle appear unfeasible. The TVL spread across the entire price range is able to prevent both artificially elevated and depressed oracle prices.

We therefore give wstETH a strong oracle rating. Here’s the oracle report.

Decentralisation

wstETH appears well-distributed amongst different holders.

Volatility

wstETH/WETH price has been historically stable around 1:1 + reward accumulation.

Liquidity

wstETH trades on Uniswap v3, Balancer and Sushiswap with decent arb activity. stETH, is traded heavily on Curve and is one of the most liquid pools in DeFi.

Smart Contract Risk

stETH has been audited by multiple teams of engineers and auditors.

Conclusion

wstETH ranks high on oracle security, volatility, liquidity, decentralisation and smart contract risk. We therefore recommend implementing the proposed eIP.

Relevant Links

Oracle grading tool: https://oracle.euler.finance/