Summary

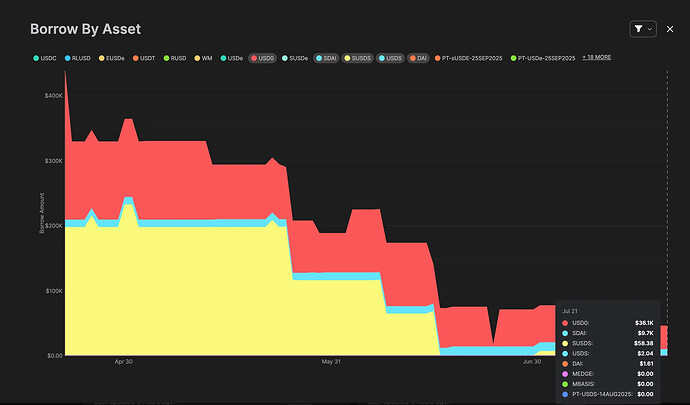

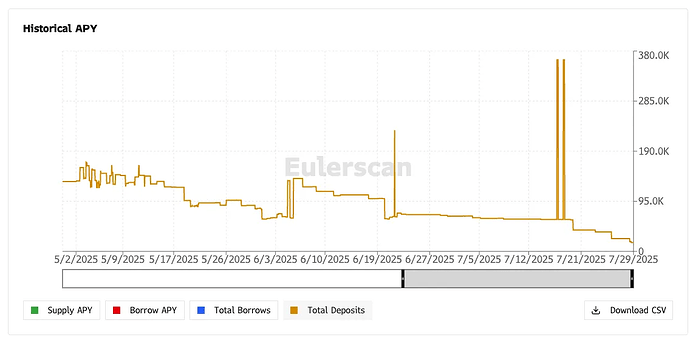

Gauntlet recommends delisting mBASIS, USD0, DAI, sDAI, USDS, sUSDS, and PT-USDS-14AUG2025 from Euler Yield. Demand for these vaults has been weak with little demonstrated user demand, and removing them from Euler Yield will reduce the protocol’s overall risk exposure.

Description

The listed assets (except for sUSDS) have not seen significant traction in the last 90 days. The combined supply amount (in $) for these assets is less than $150K, and the borrow amounts total less than $50K.

As the yield of sUSDS has decreased, its demand has also diminished, as users have shifted to other yield strategies. Gauntlet recommends delisting these assets from Euler Yield to reduce protocol risk exposure.

Offboarding Process

Gauntlet proposes offboarding these assets from Euler Yield utilizing the following process listed below:

- Set supply and borrow caps to 0 (to allow repayments and withdrawals only).

- Inform users about the offboarding on public channels.

- Ramp down collateral LTVs on offboarded vaults to 0 over 30 days.

- Once the vaults hit zero supply, they can be safely delisted from the UI.

Next Steps

- We welcome community feedback.