Summary

Gauntlet recommends the following risk parameters should the community choose to onboard OpenEden T-Bills (TBILL) to the Euler Prime/Yield markets.

Note: These recommendations are contingent upon successful oracle integration and implementing an instant redemption solution for TBILL.

Specification

Euler Prime

| Supply Cap | Borrow Cap |

|---|---|

| 10M | N/A |

| Collateral | Debt | LLTV | Borrow LTV |

|---|---|---|---|

| TBILL | USDC, USDT, RLUSD, USDS, USDtb | 0.93 | 0.91 |

Euler Yield

| Supply Cap | Borrow Cap |

|---|---|

| 45M | N/A |

| Collateral | Debt | LLTV | Borrow LTV |

|---|---|---|---|

| TBILL | USDC, USDT, RLUSD, USDS, USDtb, USDe, DAI, PYUSD, USD0 | 0.95 | 0.93 |

Rationale

Token Overview

- $TBILL is backed 1:1 by a pool of U.S. T-Bills and USD.

- $TBILL is only accessible to professional investors who have successfully completed the TBILL Fund’s KYC and KYT process.

- Transfers of an Investor’s positions are permitted only to other whitelisted Investors.

Redemption

- Only KYC’d and whitelisted accredited users can mint or redeem TBILL in exchange for USDC through OpenEden’s smart contract vault.

- While the smart contract is live 24/7, redemption settlements (especially large or full withdrawals) are typically executed on the following US business day.

- There is no upper limit for withdrawal.

- There is a five-bps transaction fee charged on redemptions.

Onchain Circulation

-

Onchain circulation: ~140M

-

Total holders: 30+

-

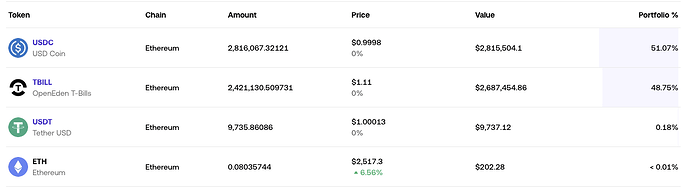

The top holder holds 60-70% of TBILL circulation, with the following portfolio:

-

Top holders’ portfolios are heavily concentrated in TBILL, with blue-chip stablecoins commonly held alongside (see sample portfolios below). We anticipate that the borrow demand against TBILL will primarily be for blue-chip stablecoins.

LLTV Recommendations

We propose applying the same LLTV parameters for TBILL as those recommended for sBUIDL by Objective Labs.

| Market | Collateral | Debt | LLTV |

|---|---|---|---|

| Euler Prime | TBILL | USDC, USDT, RLUSD, USDS, USDtb | 0.93 |

| Euler Yield | TBILL | USDC, USDT, RLUSD, USDS, USDtb, USDe, DAI, PYUSD, USD0 | 0.95 |

Next Steps

- We welcome community feedback.

- We will assess the borrowing demand for other assets, such as WETH, using TBILL as collateral.