Summary

This proposal seeks approval to list wsuperOETHb as a collateral and borrow asset on Euler Base market.

Motivation

About wsuperOETHb

Super OETH (superOETHb) is the next iteration of OETH, a superior LST with an extremely tight peg and high yields thanks to a combination of the OETH AMO and DVT direct staking through SSV/P2p. superOETHb yields are able to reach double digit levels, making it an exceptionally perfect token for lending and borrowing against ETH. superOETHb was built reusing 90% of the code from OETH, for which the codebase has already been audited 12+ times, and for which there are already active markets for on Euler

Super OETH is the first token in a new category of liquid staking: Supercharged LSTs. Supercharged LSTs will have materially higher yield while being designed for L2s, with a similar risk profile to mainnet LSTs. Ethereum liquid staking is amplified with chain-specific, auto-compounded incentives. Deep concentrated liquidity pools guarantee exits with minimal costs - users will never lose ability to convert back to ETH.

We’ve noticed many LSTs trade below their peg due to DEX fees and slippage, and to reflect the time value of money. LSTs that consistently trade below peg effectively impose a hidden exit fee - certain LSTs often trade ~0.25% below peg, meaning it takes three weeks of staking to break even. This may be ok for long-term holders, but is terrible for projects who plan to integrate the LSTs, or for users who plan to loop LTSs for additional yield. This was not the case with OETH, and it will not be the case with Super OETH.

Using Super OETH on Euler will produce higher yield than the other top LSTs and have a near perfect ETH peg. Utilizing a concentrated Aerodrome liquidity pool with the tightest tick possible helps make Super OETH the most pegged L2 LST currently available, while being able to reach double digit yields. Our vision for Super OETH is for it to become the most trusted LST for those seeking to use an LST for leveraged staking.

wsuperOETHb is a ERC-4626 tokenized vault designed to accrue yield in price rather than in quantity. When you wrap superOETHb, you get back a fixed number of wsuperOETHb tokens. This number will not go up - you will have the same number of wsuperOETHb tokens tomorrow as you have today. However, the number of superOETHb tokens that you can unwrap to will go up over time, as wsuperOETHb earns yield at the same rate as standard superOETHb. The wsuperOETHb to superOETHb exchange rate can be read from the contract (0x7FcD174E80f264448ebeE8c88a7C4476AAF58Ea6, function number 16), or via the OETH dapp.

Current exchange rate as of 3/11/25: 1 wsuperOETHb = 1.05009397 superOETHb

Why wsuperOETHb on Euler Base?

Enabling lend and borrow support for wsuperOETHb on Euler will provide a new market for OETH holders and Super OETH holders, and add a new platform for leverage looping ETH. This new Super OETH market would lead to additional increased TVL for Euler’s Base instance, additional revenue to the Euler Protocol and DAO from active loans and liquidations, and will attract a wider user base due to Super OETH being significantly higher yielding over the other Euler supported LSTs.

Acquiring wsuperOETHb

Obtaining superOETHb is effortless, users can convert their ETH into Super OETH via any of the following methods:

- Minting on the Super OETH dapp

- Swapping on WETH/superOETHb

- Swapping on OGN/superOETHb

Performance

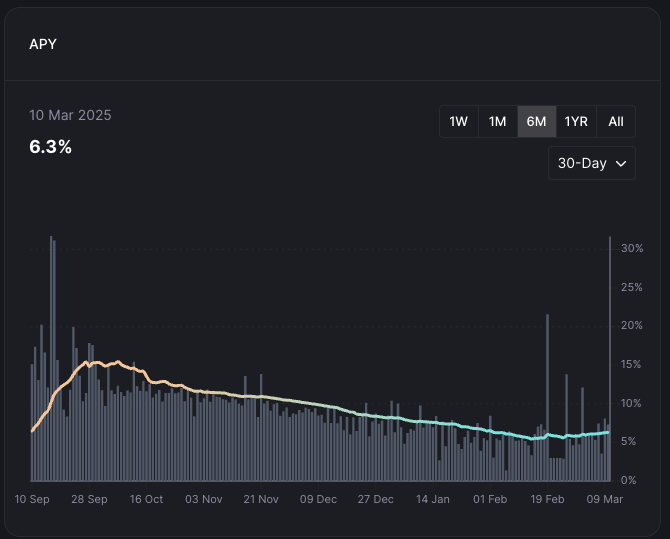

Super OETH has seen incredible growth since launch. Proof of Yield tracks the distribution of each Super OETH rebase event and displays the compounded yield on an annualized basis each day. The current Super OETH TVL sits at $244.85m with a native yield over 6% APY:

Super OETH is currently sitting as the number one spot by TVL on Defillama for yield projects on Base.

Security Considerations

superOETHb and wsuperOETHb were built reusing 90% of the OETH code, which was built reusing 95% of the OUSD code, of which many audits have been done since 2020. Not that long ago, OUSD reached a market cap of $300m without breaking, and without diminishing the APY it was capable of generating. All OETH audits can be found in the audits section of the OETH docs. We have retained yAudit to look at our PRs as we code, and OpenZeppelin is also held on retainer to review 100% of the OETH and OUSD smart contract changes. Origin maintains an active bug bounty with rewards ranging in size from $100 OUSD for minor issues to $1,000,000 OUSD for major critical vulnerabilities. The bug bounty program is currently administered by Immunefi, where Origin maintains a median resolution time of 6 hours.

Through its integration with Aerodrome, Super OETH is able to ensure a 1:1 peg with ETH at any scale. The Super OETH AMO holds a portion of the protocol’s underlying collateral in a concentrated liquidity pool with an extremely tight price range within a single tick above 1.0000 WETH. This allows anyone to sell superOETHb into the pool for at least 1 WETH (minus swap fees). The Aerodrome TWAP quoter, which works similar to the Uniswap TWAP oracle, can be used to derive the price of superOETHb on chain, and a superOETHb Tellor oracle is also available. superOETHb is also derived from OETH, which has mainnet oracles from Chainlink, Tellor, and Dia. superOETHb redemptions back to ETH are available via the superOETHb dapp at a 1:1 rate.

Market parameters

Loan-to-values (LTVs) and supply & borrow caps will be set by Gauntlet or another risk steward. We suggest the parameters be more favorable to those set on Morpho, Ionic, Radiant, Silo, Zerolend, and Venus so Euler can be more competitive with those markets.

We also encourage the Euler DAO and community members to provide feedback, share suggestions, and voice their opinions on this proposal.

Relevant links: