Proposal to List AUSD as a Collateral and Borrowable Asset in Euler Prime & Euler Yield Markets

Summary

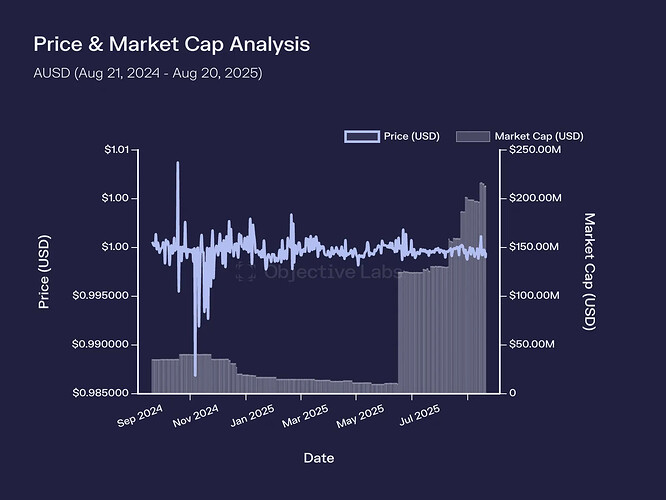

This proposal seeks community approval to list AUSD, Agora Finance’s fully-backed USD-pegged stablecoin, as a collateral and borrowable asset in both the Euler Prime and Euler Yield markets. Adding AUSD will provide users with more high-quality stablecoin options, expand collateral diversity, and enable new DeFi strategies within Euler.

Motivation & Context

AUSD is a fiat-backed USD stablecoin issued by Agora Finance and redeemable 1:1 for USD via Agora’s platform. It is designed with mechanics similar to USDC, maintaining its peg through fully-backed reserves and robust redemption mechanisms. AUSD is ERC-20 compliant, with no transfer restrictions.

The reserves backing AUSD are held in Agora Reserve Trust, a Delaware Statutory Trust.

Custody: Assets are held with State Street, one of the world’s largest global custodians, which also acts as fund administrator.

Fund Management: The Agora Reserve Fund is managed by VanEck, a global asset manager with more than $130B in assets under management, investing primarily in overnight repurchase agreements, U.S. Treasury Bills, and cash.

This combination of regulated trust structure, institutional custody & professional fund management ensures institutional-grade security, transparency, and oversight.

Benefits to Euler Users

Collateral Diversity: Expands stablecoin options for lending, borrowing, and strategy building.

Capital Efficiency: Facilitates looping, hedging, and yield optimization strategies.

Institutional Trust: Attracts both retail and institutional users through regulated, transparent reserve management.

In Prime: Introduces a fully backed, institutionally managed stablecoin to Euler’s curated market, increasing user choice for stable collateral with deep liquidity and strong peg integrity.

In Yield: Enables AUSD & yield-bearing wrappers of AUSD to be used as collateral while accruing yield, supporting looping and leveraged yield strategies alongside other Prime/Yield assets.

Risk Parameters

We defer to Gauntlet to recommend reasonable risk parameters for AUSD in both Prime and Yield markets.

Oracles

AUSD pricing can be sourced from established decentralized oracle providers like Pyth referencing deep liquidity pools against USDC/USDT.

Liquidity Pools

AUSD/USDC (Uniswap V4)

AUSD/USDT (Uniswap V3)

AUSD/USDT (Balancer V2)

Security Considerations

Smart Contract Audits:

Agora Dollar EVM – Cantina & Spearbit (June 2024)

Agora Dollar EVM – Certora (July 2024)

Agora Dollar SUI – Zellic (August 2024)

Agora Dollar SUI – MoveBit (September 2024)

Reserve Attestations: Monthly management reports independently verify reserve composition and backing.

Full Archive

Important Links

Website

Documentation

Audit Reports

Attestations

Contract Deployments

Ticker: AUSD

Contract Address: 0x00000000eFE302BEAA2b3e6e1b18d08D69a9012a

Next Steps

Upon approval, Gauntlet will run its risk modeling and finalize parameters for AUSD’s inclusion in both markets.