the template for replies to original post ?

i think he’s asking you to update the original post.

thank you - we actually synced up in DMs. This isn’t my post ![]()

We support this proposal as it is important to strengthen the oracle to prevent an attack and would also serve as a method of diversifying the treasury.

We agree it should be full range as the Euler docs say “it’s crucial to provide full-range liquidity” to improve a project’s oracle rating.

As mentioned previously by @AltoOptimo, supplying at full range would require supplying more EUL than ETH. For example currently, if we were to supply 46,555 EUL ($250,00) we would need to supply 58.82 ETH ($75,084).

Currently, the EUL TWAP oracle is rated medium risk as it is estimated to cost $8.65M to decrease the price by 20%.

In order to change the oracle rating to low it would need to cost at least $50M to increase or decrease the TWAP oracle 20% over 2 blocks.

Adding 500,000 might be more than necessary as it would increase the TLV by nearly 5X and might encourage some to dump EUL. We recommend starting with 30,000 EUL ($161,100) and the corresponding 37.91 ETH ($48,350). This is a total of about $209,450 and would increase TLV in the pool by more than 3x and would be a very small percentage of the total treasury (~0.25%) (or ~0.76% of the treasury value held in stablecoins). Additionally, this is estimated to earn $110700.08 per year or 52.85% APR.

If this is not enough to change the oracle rating to low risk then we recommend adding additional EUL and ETH until the low-risk rating is achieved.

@Matt_StableNode , great post! I’m glad to see you guys become more involved with Euler. I’d like to point out that it takes approximately $36M to reduce the price by 20% in 2 blocks. After entering the desired percentage change for the given pair (EUL-ETH) in the Oracle tool, you click on report. There are two graphs in that report that show how much it will take to move the price in either way over 1 to 10 blocks.

Keen to revive this thread.

I still think it’s embarrassing how little liquidity there is for the EUL token. The oracle is super weak, and on top of this, it’s incredibly difficult to onboard new investors. It doesn’t have to be this way.

Using DexGuru’s metrics for liquidity we can compare the EUL token with some other DAO tokens on decentralised exchanges:

$125,000 poor liquidity, weak oracle. Does this look like a future top 5 DeFi protocol’s token?

$831,000, decent liquidity. Recently launched token, innovative launch that bootstrapped liquidity. This isn’t sustainable but they are going down the Curve route, potentially inducing bribes, etc down the line (Thankfully, we don’t need to do this).

$785,000, reasonable liquidity. Majority protocol-owned liquidity (POL)

$747,000 reasonable liquidity. Majority POL

**$2136,000 good liquidity. Mature protocol that has strong liquidity in many locations. **

I think we should have at least reasonable liquidity at this stage.

How do we get there @Matt_StableLab, @connormartin and @AltoOptimo ?

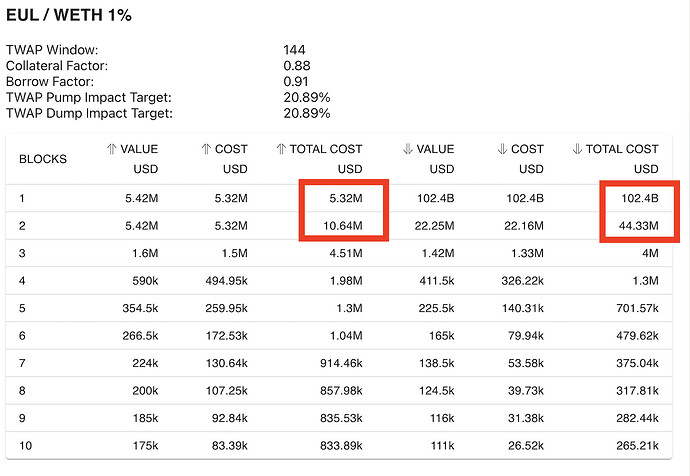

Focusing on the oracle, the updated cost of attack to increase price by over 20.89% (minimum required to break even on highest-quality assets) in 2 blocks is $10.64M, to decrease is $44.33M.

If we wanted to bump that up and achieve a strong oracle, getting closer to the $50M target we need to add liquidity.

I believe we should be providing more than the suggested $200,000 -$325,000. If comparing to the industry I think the DAO owning $600,00 of liquidity is a step in the right direction. This would get us to roughly $723,000 including the $123,000 of liquidity already present on DEX’s.

This would require: 108.457ETH and 95,000EUL. 0.62% of the USDC treasury ($169,250 to buy the ETH) and 1.09% of the EUL treasury. This is 0.87% of the total treasury.

I would recommend a 1% fee and a full-range position on the Uniswap V3 ETH-EUL pair. This could earn around $118,000 at 18%APR. These earned fees could claimed quarterly and be used to fund grants or other incentives in the DAO.

One point is that increasing liquidity could increase sell pressure from farmers. I will revert to @phoenix 's comment on this:

If there’s concern around farm and dump, which might be valid, I believe those should be addressed separately - in tokenomics design itself. Otherwise we’re implementing tokenomics based on assumptions of very thin on-chain liqudity, which is sub-optimal imo.

I say if they want to sell they can sell it’s a free market. There are better and more sophisticated ways of exiting positions than market selling. But if it’s market selling they want, then the DAO will happily charge a 1% fee for the convenience.

Please weigh up the risks and benefits of this. It’s important not to be short-sighted and only think of today, try to think long-term.

At this stage, I believe the EUL token should have a strong oracle and reasonable liquidity embracing POL, let’s make it happen.

im ready to vote in favor of this - how do we move it to a vote?

I will add that i disagree with increasing the suggested liquidity amount. Following trends of the industry, or standards set by other protocols is not a helpful line of thinking imo. Im in favor of keeping it first-principles focused and sticking to the originally suggested contribution amount

Thank u @knightsemplar for the profound overview. I agree on that Euler market requires a stronger oracle rating. So I tend to support your suggestion.

The only concern I have is the place to bring liquidity to. What I mean is that the EulerSawap is going to be launched in the future. I do not know when it is going to happen and what functionality it is going to deliver, but would not it be more prudent to wait till EulerSwap to bring liquidity there, rather than to other DEXes?

PS. Maybe EulerLabs could clarify this

I don’t think the original amount is valid right now. Unless you mean some of the later suggestions? What amount are you more aligned to?

If we want a strong oracle, the liquidity needs to be increased by a large amount. You’ll have a better understanding than me.

If the current cost to attack is 10M over 2 blocks (20.89% price increase) then should we need 5x more ($500k) to hit that target? Maybe @kasp could add some color here.

We can take this to eIP when we come to a consensus on liquidity value.

Thank you and yes, some clarification would help. But I feel like that is some time away.

We could always migrate when the time comes.

Please please proceed with this proposal

@knightsemplar Thanks for creating this proposal, as a long-term holder and a user I tend to agree that liquidity should be improved (although, a contrary question: is this problem really worth solving?). However, I think the proposed solution is not optimal. Here are some rough thoughts:

- I think that liquidity should be attracted organically. As the interest in a protocol is growing, liquidity will come. We can already observe x2 TVL growth within the past few weeks. Also, solutions for automated uni v3 position management are emerging like charm finance → this attracts less sophisticated MMs/LPs → liquidity is growing. Subsidizing liquidity is a temporary solution and past experience shows that liquidity mining is not always the best answer. I think Euler already is not at the stage that requires liquidity bootstrapping.

Also, is this a real problem worth solving? As it was mentioned earlier in the discussion, it might just help farmers to exit and/or push the price higher. But are these objectives key to a protocol?

Additionally, such a solution might push away organic LPs because of severe dilution. Of course, such LPs are not primal users for Euler, but more likely they are real holders (the hypothesis is that the searches don’t usually take a directional risk by holding long-tail tokens), so their interests should be accounted for as well.

- LPing in a 1% fee pool as a full-range position is not capital efficient. a) If the goal is to improve liquidity and holders number, it should be supplied to a 0.3% pool because 1% is not attractive for traders and is designed by its nature to increase r/r for LPs of long-tail tokens and bootstrap initial liquidity sacrificing capital efficiency; b) a full-range is not efficient because most of the tvl will be outside of the range thus useless liquidity distribution.

Summary: agree that liquidity should be increased in the long-term (but again a contrary question: is this a real problem to solve)? Yet, I guess the final proposal should be refined. Would love to participate in this activity.

Full disclosure: I’m personally LPing in Uni v3 weth/eul pool and farming EUL to accumulate as well.

P.S. Not directly related to this topic but as food for thought – it’d be cool to design a solution for how EUL in (1) Uniswap and (2) Euler can participate in voting. This might lead to an organic liquidity increase.

Thanks @nikita, #DimaJedi#5534 for the ideas and discussion.

1,000% in favor of this.

Also agree - when Euler Swap launches the DAO should probably move this liq from UNI onto EulerSwap. Or at least add more to ES. But I think that’s discussion for that time when it’s actually launched. Meantime let’s get some on chain liq.

This liq won’t come ‘organically’ - no magic appearance - it has to be provided. DAO is by far and away the largest EUL holder rn - as it should be. So to quote this gent here (–> Hillel the Elder - Wikipedia). If not DAO (now), then when? ![]()

The relation between cost of attack and liquidity (if it’s full range) is not linear. Markets get the higher oracle tier on Euler when the cost of attack (either pump or dump) is above $50M. To get the exact numbers how much liquidity would be needed I’d need to run some calculations, but we can look at other markets to save time. I.e. we have MILADY market that has the cost of attack as follows:

Estimated risks of manipulation: Low

Cost needed to manipulate a 30 minute TWAP:

- $71.22M to increase by 20%

- $355.92M to decrease by 20%

https://app.euler.finance/market/0x227c7df69d3ed1ae7574a1a7685fded90292eb48

As you can see, it’s pretty close to $50M. MILADY has full range liquidity on Uni v3 that consists of:

Total Tokens Locked:

MILADY 14.70

ETH 26.92

https://info.uniswap.org/#/pools/0xbe6a94f7db00bb309a7bd16b084b45115b070510

It means that at current price of ETH, it would be enough to have more or less 50 ETH full range (25 ETH vs appropriate amount of EUL) to bump EUL to the highest oracle tier.

Currently the 1% Uni v3 EUL/WETH liquidity pool has about right amount of liquidity, but it’s concentrated.

https://info.uniswap.org/#/pools/0xb003df4b243f938132e8cadbeb237abc5a889fb4

Thanks for this @vadym good to have you in the discussion.

I think this is a problem worth solving.

There is no subsidisation, the liquidity will be fully owned by the DAO, as well as the rewards. We can always reassess and take the assets back later. But for now, with so much EUL, why not make it more productive?

Liquidity will certainly come organically as the token is distributed, but that is a slow process.

Full-range liquidity is necessary to improve the EUL oracle.

I realise there are more capital-efficient ways to market make but I don’t think we need to overcomplicate things and add risk by using other protocols. The 1% and full range will actually give the smaller LPs a chance to capture more of the liquidity. The DAO owed liquidity would be a buyer or seller of last resort so to speak.

I think we agreed that we need some liquidity on-chain.

How much would you prefer?

- $600,000

- $500,000

- $400,000

- $300,000

- $200,000

- $100,000

- $75,000

- $50,000

- $0

0 voters

And the fee for UniSwap v3 EUL-WETH full range:

- 1%

- 0.3%

0 voters

Thanks, Kasp, so at minimum, we would need $80,000 in total liquidity to get the oracle boosted.

I just wrote a message that we’d need 25 ETH x 2 of value, which is 50 ETH ($75k) in total, but we have a poll with voting options $100k upwards…

I didn’t see the reason to be exact on something that changes so rapidly. I also don’t think it mattered as the dollar amounts discussed in the thread were already higher.

If there is enough demand I can certainly lower the amounts. This is just a gauge of interest after all.

I fully agree, but in all fairness I’d add options of $0 and $50k as well ![]()