Gauntlet is aligned with the Objective Labs recommendations for PT-USDe-25SEP2025, PT-pUSDe-16OCT2025, and PT-tUSDe-16OCT2025 on Euler Yield. There has been strong user demand for these Pendle PTs, and the increase in caps align with the risk metrics.

You keep increasing the upper limit of PT supply without increasing the slope of USDT USDC. This will make the liquidity of Euler tight, and will not attract more PT owners to loop, nor will it attract more people to lend USDT/USDC.

Objective Labs: Parameter Updates on Ethereum (2025-08-26)

| Market | Asset | Base Rate | Kink (%) | Rate @ Kink | Rate @ 100% (Max) |

|---|---|---|---|---|---|

| Euler Yield | USDC, USDT, | 5% | 90% | 10% | 15% → 20% |

Rationale

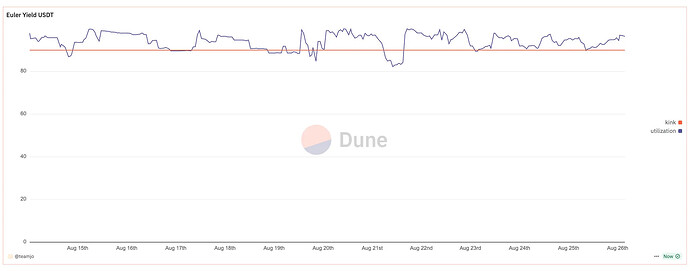

Since updating the Max Interest Rate of Euler Yield to 15%, the utilization for both USDC and USDT has hovered above the kink threshold over 84% of the time. Based on this persistent overutilization, Objective Labs recommends increasing the maximum interest rate to 20% to help attract additional supply and restore healthier pool utilization levels.

USDC Kink Utilization

USDT Kink Utilization

I am glad that you have taken my suggestion seriously. But 20% is not enough, it should be 25%.

You’re 100% correct, but it looks like Gauntlet clowns may counter your suggestion

Gauntlet is aligned with the Objective Labs recommendations for USDC and USDT IRMs on Euler Yield. Recommend using the same recomendations for frxUSD on Euler Yield as well.

[Gauntlet] Parameter Updates on Arbitrum (2025-08-28)

| Market | Vault | Supply Cap | Borrow Cap |

|---|---|---|---|

| Euler Arbitrum | TETH | 100 → 150 | 50 → 75 |

Rationale

Gauntlet recommends increasing the caps for TETH as caps have reached their limits. There is enough DEX liquidity to support the cap increase. A 150 TETH swap to WETH has an estimated slippage of 0.7%.

Next Steps

- We welcome community feedback.

Objective is aligned with Gauntlet’s CRS update recommendations for tETH on Arbitrum.

[Gauntlet] Parameter Updates on Ethereum (2025-08-29)

| Market | Vault | Supply Cap |

|---|---|---|

| Euler Yield | PT-pUSDe-16OCT2025 | 50M → 60M |

Rationale

Gauntlet has applied a VaR (Value at Risk) Framework to evaluate the supply cap for PT-pUSDe. Using the 95th percentile value, which can be swapped at <5% slippage under stressed scenarios, we recommend increasing pUSDe’s PT supply cap to 60M.

Next Steps

- We welcome community feedback.

Objective is aligned with Gauntlet’s recommendation for PT-pUSDe.