This is the monthly continuation of CapRiskSteward updates.

Previous update threads:

Summary

Euler Labs and Objective Labs recently developed the CapRiskSteward smart contract as a fast lane for non-critical parameter updates. Following its implementation for the Euler DAO markets, we propose that service providers follow a notification process for in-scope changes. By establishing this process we seek to give the Euler community full transparency into the work done by service providers to optimize and grow Euler DAO markets.

1 Like

[Gauntlet] - Parameter Updates on Ethereum (10-15-2025)

Overview

Gauntlet proposes reducing caps for PYUSD vault on Euler Yield due to a recent 300 trillion Mint and Burn transaction on Ethereum.

Rationale:

A 300 trillion mint and burn transaction for PYUSD occurred today. The Paxos team communicated this was done in error. While funds are safe, this error demonstrates how easily the token can be minted. PYUSD markets have shown low demonstrated user demand on Euler Yield. Gauntlet recommends reducing the supply and borrow caps of PYUSD by 50% to reduce risk exposure to the protocol.

Mint : Ethereum Transaction Hash: 0xc45dd1a77c... | Etherscan

Burn : Ethereum Transaction Hash: 0xaa532ae7f0... | Etherscan

Paxos Announcement: https://x.com/Paxos/status/1978565015943950411

Cap Recommendations

| Vault |

Borrow Cap |

Supply Cap |

| PYUSD |

2.25M → 1.13M |

2.5M → 1.25M |

Next Steps

- We welcome community feedback.

1 Like

Objective Labs is aligned with Gauntlet’s recommendation to further lower the Supply and Borrow Caps for PYUSD on Euler Yield. Activity has been low since February of this year. This measure is intended to prevent any risks associated with the recent mint/burn mistake.

1 Like

Objective Labs: Parameter Updates on Ethereum (2025-10-20)

| Market |

Asset |

Base rate |

Kink |

Rate at kink |

Rate at 100% (max) |

| Euler Yield |

USDC, USDT, PYUSD, RLUSD, wM, USDe, eUSDe, USDtb, rUSD, AUSD, frxUSD, USD1 |

4% → 2% |

90% |

8% → 6% |

20% |

Rationale

Objective Labs recommends lowering both the base and kink rates for Euler Yield markets, as utilization for USDC and USDT has fallen below 50% over the past 7 days. This adjustment aims to maintain competitive borrowing rates across the market.

Gauntlet supports Objective Labs’ proposed updates to the IRM on Euler Yield and agrees with the outlined rationale.

Lowering the base rate from 4% to 2% and the rate at kink from 8% to 6% is reasonable given that USDC and USDT utilization have remained consistently below 50%. These adjustments will help maintain competitive borrowing rates and balance supply and demand. If utilization trends increase toward target levels, we can revisit and recalibrate parameters as needed.

Objective Labs: Parameter Updates on Ethereum (2025-10-23)

| Market |

Vault |

Supply Cap |

| Euler Yield |

PT-srUSDe-15JAN2026 |

10M → 20M |

Rationale:

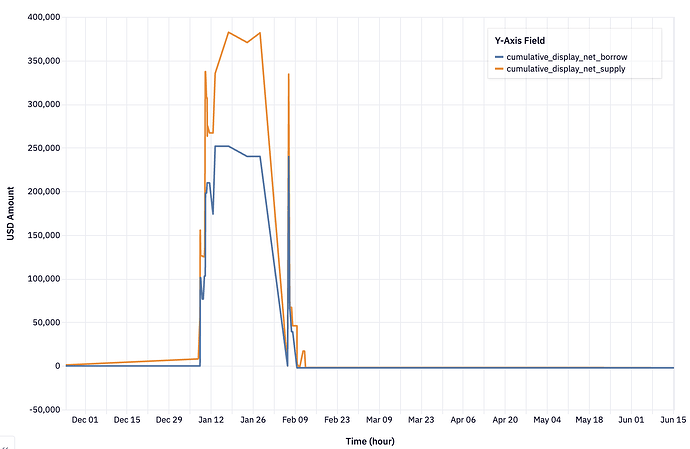

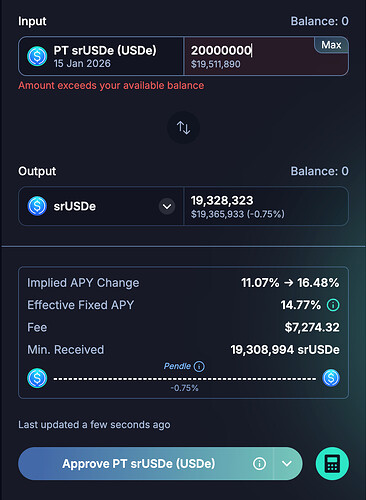

Supply cap utilization has recently reached its maximum. To support increasing user demand, Objective Labs recommends doubling the supply cap to 20M. Liquidity depth simulations show that a 20M PT-srUSDe-15JAN2026 swap can be executed with only 0.75% slippage, supported by a current liquidity pool of $55M.

Gauntlet supports Objective Labs’ proposed updates to the Supply cap for PT-srUSDe-15JAN2026 and agrees with the outlined rationale.

Gauntlet: Parameter Updates on Ethereum (2025-10-24)

Recommendation

| Market |

Vault |

Supply Cap |

| Euler Yield |

PT-srUSDe-15JAN2026 |

20M → 40M |

Rationale:

Supply cap utilization is fully utilized. To support the user demand, Gauntlet recommends doubling the supply cap to 40M. Simulations show that a 40M PT-srUSDe-15JAN2026 swap can be executed with 2.55% slippage.

Objective Labs agrees with Gauntlet’s proposal to raise the supply cap for PT-srUSDe-15JAN2026 to 40M. The increase is supported by available liquidity and sufficient market depth to handle higher utilization.

Gauntlet: Parameter Updates on Euler Prime (2025-10-24)

Recommendation

| Market |

Vault |

Supply Cap |

| Euler Prime |

rETH |

275 → 400 |

Rationale:

The supply cap is at 93%. Gauntlet recommends increasing the supply cap to 400. Liquidity simulations show that a 400 rETH swap can be executed with 0.1% slippage. There is substantial liquidity on-chain to support this with ~$87.55M of total pool TVL and nearly $58M on balancer alone.

Objective Labs agrees with Gauntlet’s recommendation to increase the rETH supply cap on Euler Prime (correction from Euler Yield). Market depth shows enough liquidity to support the proposed cap increase.

Gauntlet: Parameter Updates on Euler Yield (2025-10-27)

Recommendation

| Market |

Vault |

Supply Cap |

| Euler Yield |

PT-srUSDe-15JAN2026 |

40M → 80M |

Rationale:

The current supply cap is fully utilized, indicating strong market demand. Approximately $57M worth of PT-srUSDe-15JAN2026 is available for swaps.

In a stress scenario where PT-srUSDe-15JAN2026 experiences a 10% depeg, about $12.5M in loans would be subject to liquidation. This exposure is adequately supported by existing Pendle DEX liquidity.

Assuming a proportional increase in exposure with a higher cap (i.e., a 2× rise in loans at risk under similar depeg conditions), the current Pendle liquidity depth remains sufficient to absorb potential liquidations in the scenario of a 10% depeg event.

Objective Labs is aligned with Gauntlet’s recommendation to increase the supply cap for PT-srUSDe-15JAN2026 from $40M → $80M.

Rationale

Simulated Cap Increase vs. Current Liquidity Composition

PT-srUSDe-15JAN2026 currently holds $60M in total liquidity, with $45.92M in srUSDe (Jan 2026 SY) acting as the effective reference liquidity for stressed market conditions.

Under the proposed cap increase from $40M to $80M, the stress simulation indicates the system remains solvent up to a 15% price decline, with sufficient liquidity to absorb liquidations before any bad-debt formation.

| shock_mult |

price_drop_pct |

liquidatable_accounts |

scaled_debt |

scaled_collateral |

stressed_liquidity |

solvency_status |

liquidity_status |

| 1.0 |

0.0 |

0 |

$0.00M |

$0.00M |

$45.92M |

No bad debt |

Inside threshold |

| 0.95 |

5.0 |

4 |

$3.31M |

$3.75M |

$45.92M |

No bad debt |

Inside threshold |

| 0.9 |

10.0 |

14 |

$38.64M |

$41.80M |

$45.92M |

No bad debt |

Inside threshold |

| 0.85 |

15.0 |

15 |

$38.84M |

$39.68M |

$45.92M |

No bad debt |

Inside threshold |

[Gauntlet] Parameter Updates on Euler Yield & Prime (2025-11-11)

Recommendation

| Market |

Max Borrow APY |

| Euler Yield |

50% → 20% |

| Euler Prime |

30% → 13% |

Rationale:

Due to a liquidity crunch and overall supply outflows during the events last week, Gauntlet and Objective Labs increased the max APYs to stabilize markets on Euler Yield and Euler Prime. The higher APYs encouraged additional supply to these markets, helping drive down elevated utilization. As markets have returned to equilibrium, Gauntlet recommends restoring these max APYs to their original values.

Objective Labs supports Gauntlet’s proposal to restore IRM max rate to their original optimized values.

Gauntlet: Parameter Updates for Euler Prime

Overview

Gauntlet proposes reducing supply and borrow caps by 50% for Euler Prime markets that have supply and borrow cap utilization at ≤10% over the past 30 days.

Rationale

The outlined markets have demonstrated low user demand over the last 30 days, with peak utilization on both the borrow and supply sides below 10%. To reduce risk exposure, we recommend reducing the supply and borrow caps for these markets by 50%. We note that cap reductions will not affect currently open positions.

| Vault |

Supply Cap Utilization 30 Day High |

Borrow Cap Utilization 30 Day High |

| USDe |

4.67% |

4.17% |

| ezETH |

2.57% |

~0% |

| ETHx |

~0% |

N/A |

| mETH |

~0% |

N/A |

| LBTC |

7.18% |

2.79% |

Cap Recommendations

| Vault |

Supply Cap |

Borrow Cap |

| USDe |

13M→7.5M |

12M→6M |

| ezETH |

9,750→5,000 |

2,340→1,200 |

| ETHx |

2,500→1,250 |

N/A |

| mETH |

6,250→3,300 |

N/A |

| LBTC |

600→300 |

150→75 |

Next Steps

- We welcome community feedback.

Gauntlet: Parameter Updates for Euler Base and Euler Unichain

Overview

Gauntlet proposes reducing supply and borrow caps by 50% for Euler Base & Unichain markets with supply and borrow cap utilization ≤10% over the past 30 days.

Rationale:

The outlined markets have demonstrated low user demand over the last 30 days, with peak utilization on both the borrow and supply sides below 10%. In order to reduce risk exposure, we recommend reducing supply and borrow caps for these markets by 50%. We note that cap reductions will not affect currently open positions.

Euler Base

| Vault |

Supply Cap Utilization 30 Day High |

Borrow Cap Utilization 30 Day High |

| USD₮0 |

~0% |

~0% |

| EURC |

3.29% |

1.01% |

Euler Unichain

| Vault |

Supply Cap Utilization 30 Day High |

Borrow Cap Utilization 30 Day High |

| weETH |

5.51% |

0.15% |

| ezETH |

9.78% |

0.02% |

| UNI |

5.47% |

0.02% |

Cap Recommendations

Euler Base

| Vault |

Supply Cap |

Borrow Cap |

| USD₮0 |

3M→1.5M |

2.7M→1.35M |

| EURC |

20M→10M |

18M→9M |

Euler Unichain

| Vault |

Supply Cap |

Borrow Cap |

| weETH |

22,500→12,000 |

9,000→4,500 |

| ezETH |

1,500→750 |

375→190 |

| UNI |

62,500→33,000 |

50,000→25,000 |

Next Steps

- We welcome community feedback.

Objective Labs supports Gauntlet’s cap reduction proposals for Euler Prime, Euler Base and Euler Unichain.