This is the monthly continuation of CapRiskSteward updates.

Previous update threads:

Summary

Euler Labs and Objective Labs recently developed the CapRiskSteward smart contract as a fast lane for non-critical parameter updates. Following its implementation for the Euler DAO markets, we propose that service providers follow a notification process for in-scope changes. By establishing this process we seek to give the Euler community full transparency into the work done by service providers to optimize and grow Euler DAO markets.

2 Likes

Gauntlet is aligned with the proposed Cap adjustments for PT-syrupUSDC-28AUG2025, USDC, and RLUSD.

PT-syrupUSDC-28AUG2025

- PT liquidity (~$15M) comfortably supports expanding the cap to 30M, and we note it matures in fewer than 60 days.

USDC

- Deep on-chain liquidity justifies raising the supply cap to $300M and the borrow cap to $270M.

RLUSD

- Top RLUSD positions are borrowing stablecoins and then looping them to generate yield.

- There has been strong demonstrated user demand.

- Onchain liquidity can support the cap increase.

We will monitor demand post-implementation and recommend adjustments accordingly.

2 Likes

[Gauntlet] – Parameter Updates on Euler Prime Ethereum (07-02-2025)

| Symbol |

Borrow caps |

Supply caps |

| cbETH |

5,000 → 2,500 |

12,500 → 6,000 |

| USDS |

9,000,000 → 4,500,000 |

10,000,000 → 5,000,000 |

| rETH |

2,500 → 1,250 |

6,250 → 3,125 |

| sUSDS |

3,200,000 → 1,600,000 |

8,000,000 → 4,000,000 |

Rationale:

The 30-day high supply and borrow cap utilization is below 10%. To reduce risk exposure, we recommend a 50% reduction in supply and borrow caps.

2 Likes

Objective Labs has reviewed Gauntlet’s CRS items on Ethereum dated 07-02-2025 and is fully aligned. Reducing caps for these vaults lowers tail risks.

1 Like

This CRS proposal has been executed on Jul-09-2025 02:59:11 PM UTC.

2 Likes

[Gauntlet] – Parameter Updates on Euler Yield on Ethereum (2025-07-09)

| Market |

Vault |

Borrow Cap |

Supply Cap |

| Euler Yield |

mBASIS |

- |

3M → 1.5M |

| Euler Yield |

syrupUSDC |

9M → 4.5M |

10M → 5M |

Rationale:

The 30-day supply and borrow cap utilization has been consistently low (below 10%). To reduce risk exposure, we recommend reducing them by 50%.

2 Likes

Objective Labs supports Gauntlet’s CRS recommendations on Ethereum dated 2025-07-09.

2 Likes

Gauntlet is aligned with the Objective Labs 2025-07-10 USDC CRS proposal on Euler Unichain.

1 Like

This CRS proposal has been executed on Jul-14-2025 09:19:23 AM UTC.

1 Like

This CRS proposal has been executed on Jul-14-2025 09:18:51 AM UTC.

1 Like

Adjusting Euler Stablecoin IRM Recs

Background

Objective Labs recently recommended raising kink rates for stablecoins across lending markets to reflect strong demand. We reviewed industry trends over the past 30 days and observed:

- Flat SSR: Sky Savings Rate (SSR) has remained largely unchanged.

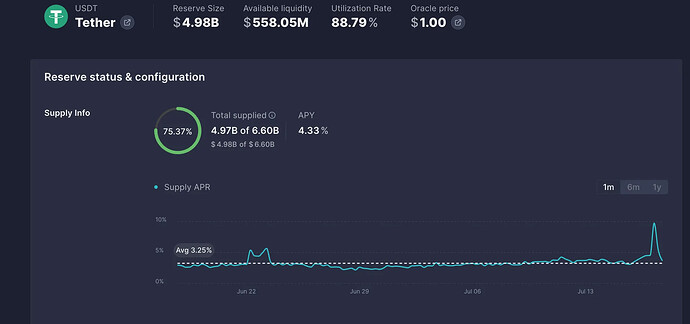

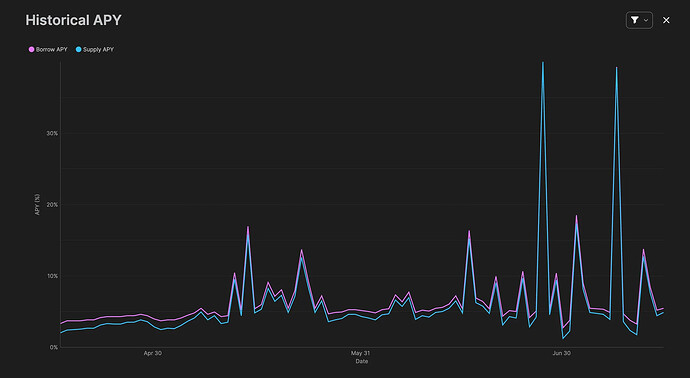

- APY Spikes on Aave: Sudden supply APR spikes for USDT and USDe on Aave, driven by rapid supply liquidity withdrawals.

While increasing kink rates can improve supply liquidity, repeated APY spikes on Euler Prime suggest an additional lever is needed to mitigate these sudden drops in supply liquidity.

Key Observations

- Utilization Spikes on Euler Prime

- Frequent sudden drops in supply liquidity for USDC and USDT in Prime vaults over the last 30 days.

- Utilization briefly hits 100%, triggering the max-borrow APY (40%) and prompting APY-sensitive borrowers to exit positions.

Chart: USDC APYs on Euler Prime

Other Stables:

- Similar utilization spikes are not observed on other stablecoins, indicating that this happens more often with USDC and USDT.

Proposed Parameter Changes

To smooth borrow APY sensitivity and discourage abrupt position closures, we recommend:

- Reducing the max‐borrow rate for USDC/USDT on Prime from 40% → 25%

- As there are no major shifts observed from other lending protocols, a smaller increase in Kink rates for Euler Yield

- Agree with the recommendations on other networks proposed by Objective Labs

| Market |

Asset |

Base Rate |

Kink (%) |

Rate @ Kink |

Rate @ 100% (Max) |

| Euler Yield |

USDC, USDT, PYUSD, RLUSD, wM, USDS, DAI, USD0, USDe, USDtb |

0% |

90% |

7.5% → 8.0% |

40% → 25% |

| Euler Yield |

rUSD |

0% |

90% |

7.0% → 7.5% |

40% |

| Euler Yield |

eUSDe |

0% |

85% |

7.0% → 7.5% |

40% |

| Euler Prime |

USDC, USDT, USDS, wM, USDtb, RLUSD, USDe |

0% |

90% |

5.5% → 6.5% |

40% → 25% |

Expected Outcomes & Risk Mitigation

- Reduced Borrower Churn: Lowering max-APY cap to 25% makes brief utilization spikes less punitive, keeping positions open.

- Improved Liquidity Depth: Higher kink-rate APR in Yield markets incentivizes additional liquidity provisioning.

Summary

By combining Objective Labs’ kink-rate adjustment with a reduced max-borrow rate on Prime, Euler can reduce APY volatility and encourage higher supply liquidity. Gauntlet actively monitors liquidity across lending protocols and will propose an increased kink rate when we see outsized borrowing demand across markets.

We welcome community feedback.

1 Like

Objective agrees with Gauntlet’s analysis of developing interest rate dynamics and is aligned with the adjusted recommendations.

1 Like