Summary

Should the community choose to onboard frxUSD onto Euler Prime and Yield and sfrxUSD into Euler Yield, Gauntlet recommends the following:

- frxUSD as a borrow and collateral token

- sfrxUSD as collateral-only token on Euler Yield

| Market | Vault | Supply Cap | Borrow Cap |

|---|---|---|---|

| Prime | frxUSD | 5M | 4.5M |

| Yield | frxUSD | 10M | 9M |

| Yield | sfrxUSD | 15M | - |

| Market | Asset | Base Rate | Kink (%) | Rate @ Kink | Rate @ 100% (Max) |

|---|---|---|---|---|---|

| Euler Prime | frxUSD | 0% | 90% | 6.5% | 13% |

| Euler Yield | frxUSD | 5% | 90% | 10% | 15% |

Token Overview

frxUSD:

frxUSD is a dollar-pegged stablecoin issued as an ERC-20 token. It is structured as a redeemable stablecoin backed one-to-one with cash-equivalent assets, primarily tokenized U.S. Treasury funds such as BlackRock’s BUIDL and Superstate’s USTB/USCC, as well as reserve holdings in USDC, USDT, and PYUSD. The token maintains direct mint and redeem functionality through net.frax.com, subject to KYC, allowing conversion into USDC, USDT, PYUSD, or fiat. Redemption is also possible into the underlying custodian assets, depending on the reserve composition at the time of withdrawal.

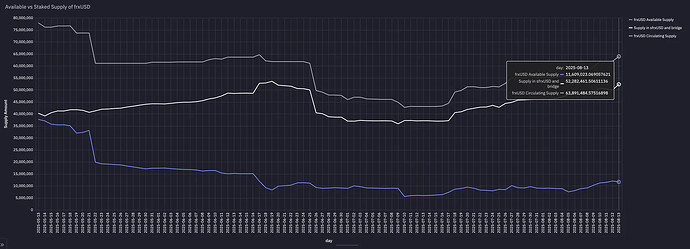

The design of frxUSD emphasizes compliance with emerging U.S. regulatory frameworks for payment stablecoins, including alignment with the proposed GENIUS Act. Custody of backing assets is handled by regulated U.S. entities (see below). There is a total circulating supply of approximately 64 million tokens, with 11.6 million actively circulating on Ethereum, excluding balances staked or bridged to other networks.

| Custodian | Reserve Asset for frxUSD |

|---|---|

| Securitize | BUIDL |

| Superstate | USCC |

| Superstate | USTB |

| Agora | AUSD |

| Centrifuge | JTRSY |

| WisdomTree | WTGXX |

sfrxUSD:

sfrxUSD is an ERC-4626 vault token that represents yield-bearing exposure to frxUSD. Users deposit frxUSD into the vault and receive sfrxUSD in return. The vault deploys its underlying assets through a Benchmark Yield Strategy, which allocates capital across tokenized U.S. Treasury funds such as BUIDL and USTB, on-chain carry trades including strategies like Ethena, and deployments into DeFi AMOs / lending markets.

Yield accrues to sfrxUSD holders through an appreciating exchange rate against frxUSD, following a mechanism similar to stETH or sDAI. Redemptions are always available at the prevailing exchange rate, though the vault does not maintain idle frxUSD balances. As a result, larger withdrawals may require unwinding external positions, which could introduce delays in stressed market conditions despite the absence of an explicit protocol lockup.

Adoption is concentrated in sfrxUSD, with roughly 33.5 million frxUSD (equivalent to approximately 52% of total frxUSD supply) currently staked into the vault.

Liquidity & Redemption

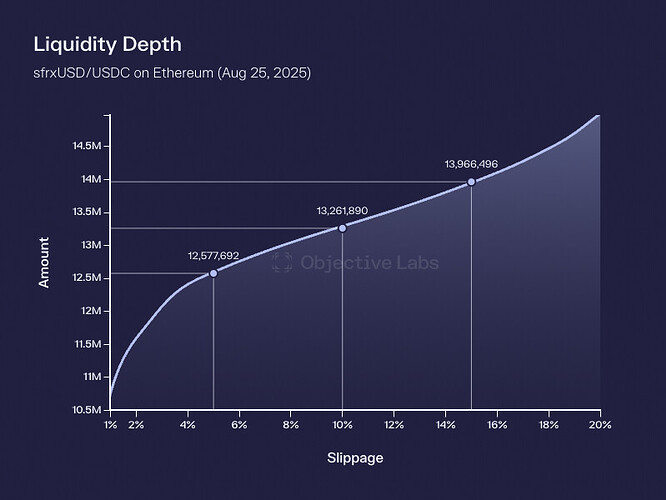

Liquidity for frxUSD is approximately $18.0 million, while liquidity for sfrxUSD is $8.1 million. Redemptions occur without delay; however, the vault does not maintain idle frxUSD balances. All underlying assets are actively deployed across strategies such as tokenized Treasury funds and on-chain carry trades. In the event of large withdrawals, the vault would need to unwind these positions to meet redemption demand. Under periods of market stress or heightened volatility, this process could introduce potential operational delays.

We note that 9 million frxUSD can be swapped to USDC below 5% slippage.

Interest Rate Model (IRM)

We recommend aligning the frxUSD IRM on Euler Yield and Euler Prime with the parameters applied to other Tier 2 stablecoins to balance borrow demand capture with appropriate risk controls:

Loan-to-Value (LLTV)

Consistent with benchmarking against other stablecoins, Gauntlet recommends setting the LLTV for frxUSD and sfrxUSD as noted below:

Euler Prime

| ↓ Collateral / Debt → | frxUSD | cbBTC | cbETH | ezETH | LBTC | rETH | RLUSD | rsETH | tETH | USDC | USDe | USDS | USDT | USDtb | WBTC | weETH | WETH | wstETH |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| frxUSD | 0.78 | 0.68 | 0.68 | 0.78 | 0.68 | 0.92 | 0.68 | 0.68 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.73 | 0.68 | 0.73 | 0.71 | |

| cbBTC | 0.84 | |||||||||||||||||

| cbETH | 0.78 | |||||||||||||||||

| ezETH | 0.75 | |||||||||||||||||

| LBTC | 0.82 | |||||||||||||||||

| rETH | 0.75 | |||||||||||||||||

| RLUSD | 0.93 | |||||||||||||||||

| rsETH | 0.75 | |||||||||||||||||

| sUSDe | 0.92 | |||||||||||||||||

| sUSDS | 0.92 | |||||||||||||||||

| syrupUSDC | 0.87 | |||||||||||||||||

| tETH | 0.75 | |||||||||||||||||

| USDC | 0.93 | |||||||||||||||||

| USDe | 0.92 | |||||||||||||||||

| USDS | 0.93 | |||||||||||||||||

| USDT | 0.93 | |||||||||||||||||

| USDtb | 0.93 | |||||||||||||||||

| WBTC | 0.84 | |||||||||||||||||

| weETH | 0.78 | |||||||||||||||||

| WETH | 0.83 | |||||||||||||||||

| wM | 0.88 | |||||||||||||||||

| wstETH | 0.81 | |||||||||||||||||

| XAUt | 0.73 |

Euler Yield

| ↓ Collateral/ Debt → | frxUSD | PYUSD | RLUSD | rUSD | USDC | USDe | USDT | USDtb | wM | AUSD |

|---|---|---|---|---|---|---|---|---|---|---|

| frxUSD | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | |

| sfrxUSD | 0.95 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 | 0.92 |

| eUSDe | 0.87 | |||||||||

| PT-cUSDO-20NOV2025 | 0.85 | |||||||||

| PT-pUSDe-16OCT2025 | 0.84 | |||||||||

| PT-sUSDE-25SEP2025 | 0.85 | |||||||||

| PT-tUSDe-25SEP2025 | 0.84 | |||||||||

| PT-USDe-25SEP2025 | 0.87 | |||||||||

| PYUSD | 0.9 | |||||||||

| RLUSD | 0.92 | |||||||||

| sBUIDL | 0.94 | |||||||||

| sUSDe | 0.87 | |||||||||

| syrupUSDC | 0.89 | |||||||||

| USD0++ | 0.87 | |||||||||

| USDC | 0.92 | |||||||||

| USDe | 0.87 | |||||||||

| USDT | 0.92 | |||||||||

| USDtb | 0.92 | |||||||||

| wM | 0.9 | |||||||||

| AUSD | 0.9 |

Oracles

For frxUSD, we recommend using the Chainlink frxUSD/USD price feed, which directly resolves to the U.S. dollar. This ensures consistency with other fiat-backed stablecoins already integrated on Euler.

For sfrxUSD, we recommend sourcing the exchange rate via the ERC-4626 convertToAssets method from sfrxUSD, by designating sfrxUSD as a resolved vault within the Euler oracle route. This construction allows sfrxUSD pricing to resolve cleanly back to USD, reflecting the vault’s underlying frxUSD-denominated value.

Next Steps

- We welcome community feedback.