Summary

Should the community choose to onboard PT-USDe-31JUL2025 to the Euler Yield markets, Gauntlet recommends the risk parameters below:

Specifications

| Supply Cap |

Borrow Cap |

| 8M |

NA |

| Collateral |

Debt |

LLTV |

Borrow LTV |

| PT-USDe-31Jul2025 |

USDS |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDe |

0.94 |

0.93 |

| PT-USDe-31Jul2025 |

DAI |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

sUSDe |

0.92 |

0.91 |

| PT-USDe-31Jul2025 |

sDAI |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USD0 |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

sUSDS |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

RLUSD |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDC |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

eUSDe |

0.92 |

0.91 |

| PT-USDe-31Jul2025 |

PYUSD |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

wM |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDT |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

rUSD |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDtb |

0.9 |

0.88 |

Rationale

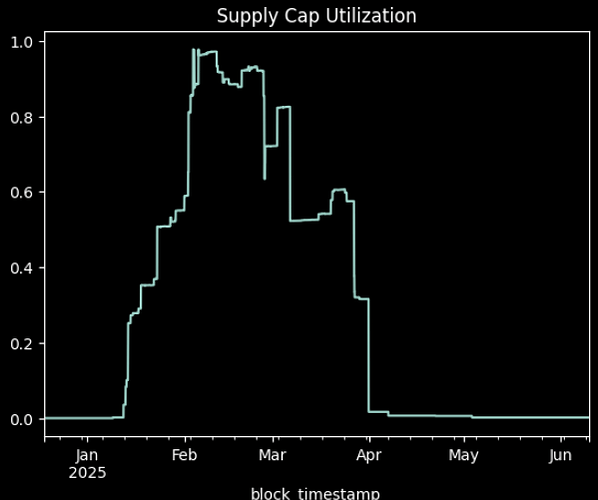

PT-USDe-27MAR2025 Vault Statistics

- PT-USDe-27MAR2025 vault was delisted in April due to expiration.

- PT-USDe-27MAR2025 vault had a supply cap of 4M with supply cap utilization maxed out in Feb.

- PT-USDe-27MAR2025 top suppliers typically borrow bluechip stablecoins like USDC or Ethena ecosystem assets such as eUSDe and sUSDe. Health factors can be as low as 1.03 when borrowing against bluechip stablecoins.

| address |

health_factor |

collateral_vault_symbol |

vault_name |

vault_borrow_balance_usd |

collateral_balance_usd |

| 0xdd84ce1adcb3a4908db61a1dfa3353c3974c5a2f |

1.23 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDC-22 |

410658 |

622042 |

| 0xc504c02cf3201199bd7961d6569b6cd6deb672bb |

1.03 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDC-22 |

436266 |

555277 |

| 0xfb74196eccf35a260dd5cfd300baa37ae058b6c0 |

1.05 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDC-22 |

270897 |

350133 |

| 0x0ed2cc2a14df153149b7a18e0055faf5ebd0e273 |

1.17 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDC-22 |

171723 |

247320 |

| 0xfb74196eccf35a260dd5cfd300baa37ae058b6c2 |

1.04 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDC-22 |

158727 |

204133 |

| 0xdf9e6beac070699b262df28bb7b0bcd7eff33d95 |

1.09 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDC-22 |

113348 |

152703 |

| 0xa4b8b17611d3cbfe17296327dfa2e114ad2391d9 |

1.29 |

ePT-USDe-27MAR2025-1 |

EVK Vault esUSDe-3 |

44976.3 |

64652.7 |

| 0xfb74196eccf35a260dd5cfd300baa37ae058b6c1 |

1.03 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDe-6 |

49596.3 |

56604.5 |

| 0x4ea96e5b2216319a9d3b8beec9b57df04d857ec2 |

1.16 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDe-6 |

35103 |

45106.5 |

| 0x082f98181163a5b8106395168f9ff2ac08915180 |

1.21 |

ePT-USDe-27MAR2025-1 |

EVK Vault eUSDe-6 |

16287.8 |

21967.8 |

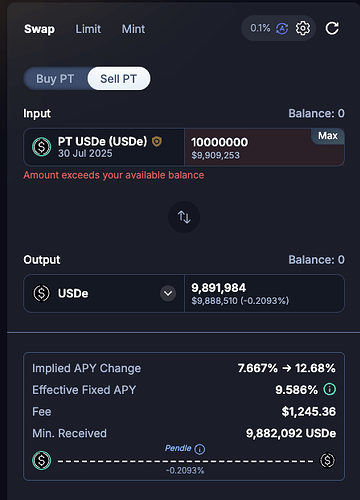

PT-USDe-31Jul2025 Pendle Pool

- Swapping 10M PT-USDe-31Jul2025 ~ USDe incurs minimal slippage

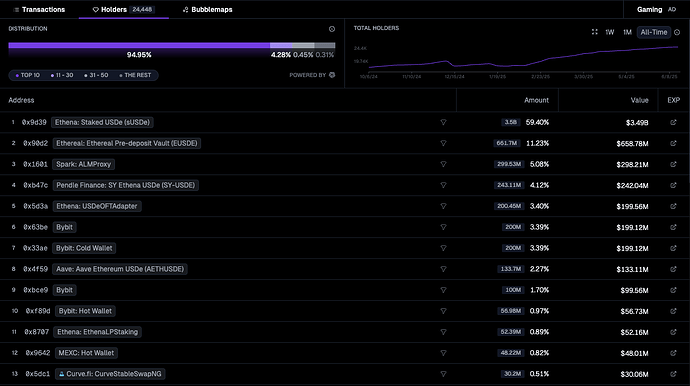

USDe DEX Pool Liquidity

- Multiple liquidity pools indicate aggressive deployment of USDe across many stablecoin pairings to seed liquidity and incentivize swaps.

| pool_name |

pool_type |

pool_url |

pool_tvl_usd |

volume_24h_usd |

| USDe / FRAX |

curve |

Link |

$68.07M |

$495.27K |

| USDe / USDC |

curve |

Link |

$8.04M |

$508.99K |

| USDe / USDT 0.01% |

uniswap_v3 |

Link |

$3.18M |

$2.44M |

| USDe / USDT 0.01% |

uniswap-v4-ethereum |

Link |

$2.91M |

$117.35K |

| USDe / USDC 0.01% |

uniswap_v3 |

Link |

$2.80M |

$524.78K |

| USDT / USDe |

curve |

Link |

$1.08M |

$3.88M |

| USDe / crvUSD |

curve |

Link |

$890.18K |

$44.60K |

| USDe / DAI |

curve |

Link |

$459.59K |

$998.00 |

| USDe / USDtb |

curve |

Link |

$114.59K |

$13.65K |

- The USDe / FRAX Curve pool leads with a TVL of $68.07M, suggesting it’s a primary liquidity source.The total holders for this pool shows steady growth over time.

- Over 70% of the token supply is held by protocol-managed contracts, indicating strong infrastructure lock-in. Bybit and MEXC represent meaningful centralized exchange holdings, suggesting meaningful retail exposure.

- While the concentration of assets in a few smart contracts enhances operational efficiency, it also introduces systemic risk. As highlighted in Objective Lab’s recent risk analysis, the aggregate market risk associated with a potential liquidity crunch has escalated to a high level.

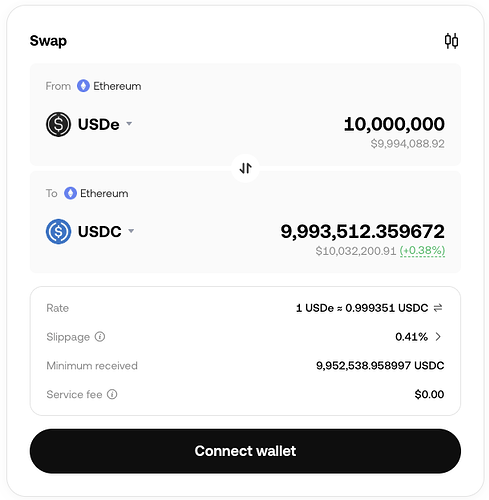

USDe Swap Slippage

USDe vaults use Pyth USDE/USD market rate oracle. As indicatd by the liquidity analysis, a $10M USDe swap can be executed with minimal slippage, highlighting deep liquidity.

Ethena Assets Vaults LLTVs

- USDe has LLTV of 90% and borrow LLTV of 88% against other stablecoins.

| Collateral |

Debt |

vault_lltv |

vault_borrow_ltv |

| USDe |

USDS |

0.9 |

0.88 |

| USDe |

sUSDS |

0.9 |

0.88 |

| USDe |

sDAI |

0.9 |

0.88 |

| USDe |

DAI |

0.9 |

0.88 |

| USDe |

USD0 |

0.9 |

0.88 |

| USDe |

USDtb |

0.9 |

0.88 |

| USDe |

USDC |

0.9 |

0.88 |

| USDe |

USDT |

0.9 |

0.88 |

| USDe |

wM |

0.9 |

0.88 |

| USDe |

PYUSD |

0.9 |

0.88 |

| USDe |

RLUSD |

0.9 |

0.88 |

| USDe |

rUSD |

0.9 |

0.88 |

- PT-sUSDE has LLTV of 88% and borrow LLTV of 86% against other stablecoins.

| Collateral |

Debt |

vault_lltv |

vault_borrow_ltv |

| PT-sUSDE-31JUL2025 |

USDS |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

USDe |

0.925 |

0.915 |

| PT-sUSDE-31JUL2025 |

DAI |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

sUSDe |

0.94 |

0.93 |

| PT-sUSDE-31JUL2025 |

sDAI |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

USD0 |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

sUSDS |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

RLUSD |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

USDC |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

eUSDe |

0.92 |

0.91 |

| PT-sUSDE-31JUL2025 |

PYUSD |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

wM |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

USDT |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

rUSD |

0.88 |

0.855 |

| PT-sUSDE-31JUL2025 |

USDtb |

0.88 |

0.855 |

Caps Recommendations

We recommend setting a supply cap of 8 million for PT-USDe-31Jul2025, twice that of PT-USDe-27MAR2025’s cap.

This recommendation is informed by a liquidity assessment, historical cap levels and utilization patterns, and consideration of the associated systemic risk.

| Supply Cap |

Borrow Cap |

| 8M |

0 (borrowing disabled) |

LLTV Recommendations

- We propose setting the Liquidation Loan-to-Value (LLTV) ratio for PT-USDe at 90% when paired with other stablecoins, given the strong liquidity between PT-USDe and USDe.

- For the PT-USDe ~ USDe pair specifically, we recommend an LLTV of 94% and a borrow LTV of 93%.

- For the PT-USDe ~ sUSDe or eUSDe pair, we suggest an LLTV of 92% and a borrow LTV of 91%.

- These recommendations are informed by the current LLTV configurations in Ethena’s asset vaults and the risk profile of PT-USDe.

| Collateral |

Debt |

vault_lltv |

vault_borrow_ltv |

| PT-USDe-31Jul2025 |

USDS |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDe |

0.94 |

0.93 |

| PT-USDe-31Jul2025 |

DAI |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

sUSDe |

0.92 |

0.91 |

| PT-USDe-31Jul2025 |

sDAI |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USD0 |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

sUSDS |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

RLUSD |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDC |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

eUSDe |

0.92 |

0.91 |

| PT-USDe-31Jul2025 |

PYUSD |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

wM |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDT |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

rUSD |

0.9 |

0.88 |

| PT-USDe-31Jul2025 |

USDtb |

0.9 |

0.88 |

Next Steps

- We welcome community feedback.

- We will closely monitor Ethena ecosystem assets and revisit their LLTV settings as needed.

- We will continue to monitor liquidity for PT-USDe-31Jul2025.

Objective Labs: Recommendations for PT-USDe-31Jul2025 on Euler Yield

Objective Labs fully aligns with Gauntlet’s recommendations of PT-USDe-31JUL2025.

Ethena assets have become de-facto blue chips through their recent integration in Aave’s v3 Core instance. We believe there is little risk in integrating PT-eUSDe on Euler Yield, given the market’s overall exposure to stablecoins, including Ethena-family assets like eUSDe and associated PTs.

We note that the $8M supply cap is on the conservative side, however we do not anticipate explosive growth downstream of the integration with to the current dynamics in Euler Yield. The $8M cap can be scaled effectively with CRS if needed.

1 Like