Title: Update the USDT Interest Rate Curve

Author: ITB Research

Submission Date: March 8, 2023

Simple Summary

This proposal suggests adjusting the USDT Kink interest rate (IR) model by reducing it from 7% to 4%, following the current DAI and USDC interest rate models. By doing so, the proposal intends to increase USDT borrows and thus protocol revenues, without significantly increasing risk.

Implementation

Current USDT Kink IR model:

| Asset | Base IR % | Kink | Kink IR % |

|---|---|---|---|

| USDT | 0% | 80% | 7% |

Proposed Kink IR model:

| Asset | Base IR % | Kink | Kink IR % |

|---|---|---|---|

| USDT | 0% | 80% | 4% |

Motivation & Analysis

Making the USDT interest rate curve more efficient presents an opportunity for Euler. Lowering the interest rate kink should attract more borrowing activity to the protocol. At the same, deep USDT liquidity on-chain allows potential liquidations to be handled in a reliably profitable manner.

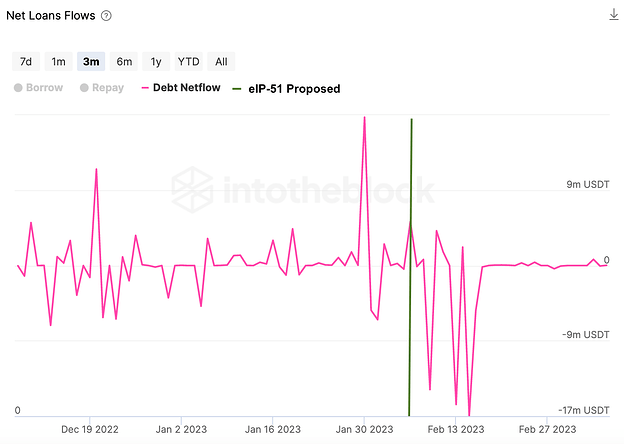

Since EIP-51 was proposed, the amount of USDT borrowing activity has shrunk by $38M, down to just $5M being borrowed at the time of writing. This represents just 2% of all Euler debt, in comparison to USDT making up 15% of borrows in Compound v2, 16% of Aave v2 debt and 4% in the case of Aave v3.

Source: Euler ITB Risk Radar

Lower USDT share of total borrows in Euler is likely due to competitors offering more competitive rates: the kink IR in Aave v2 and v3 is set at 4% and in Compound at 5%.

One reason why these rates may be lower is that these protocols don’t allow the use of USDT as collateral. This protects the protocols from the risk of bad debt being realized against USDT collateral.

But how bad is the risk of USDT leading to bad debt?

Deep liquidity on DEXes ensures liquidations can be covered accordingly for the assets supported on lending protocols. USDT’s liquidity deposited on major DEXes on the Ethereum ecosystem is over $460M. The aggregate deposited liquidity on DEXes shows promising numbers, when compared to the current borrowing activity of the Euler USDT market. This reinforces the belief that USDT’s interest rate curve should be treated as other major stablecoin assets supported by the protocol.

Moreover, the current largest depositors on the USDT market pose no risk of bad debt to the protocol. This is because the Euler USDT Staking Contract and Balancer’s Euler Boosted pool, which together make up 88% of deposits, only supply into the market.

Source: Euler ITB Risk Radar

As there are no loans taken against the USDT supplied by these two pools, current bad debt risk is only restricted to the remaining 12% of the pool, with the largest of these depositors providing $251,283 USDT.

Previously Euler has already processed liquidations for significantly larger amounts of USDT without any trouble.

Source: IntoTheBlock’s Risk Radar

In this particular case, the liquidations occurred for lack of monitoring over recursive lending (“looping”) positions. In both of these positions the liquidators profit came out to be 0.039% of the total USDT collateral, which due to Euler dutch auction liquidations mechanism, signals that liquidators were able to efficiently liquidate positions within just a few blocks.

It is also worth considering that if this proposal successfully grows USDT deposits and borrows, then the amounts to be liquidated would climb as well. Using 1Inch’s API, we estimate that liquidations of $10M, $50M and $100M USDC borrowed against USDT would result in slippage of just 0.011%, 0.020% and 0.032%, suggesting that liquidators would be able to profitably manage substantially higher liquidations.

Conclusion

Revising the USDT interest rate model should result in increased market utilization and more attractive borrowing rates. It would elevate the protocol to a more competitive position in line with Aave and Compound. The DAO would stand as the main beneficiary if the proposal is approved, as this should grow borrowing activity and thus protocol revenues.

Lastly, the increase in risk coming from the proposal should be negligible given USDT’s deep on-chain liquidity and Euler liquidators’ high efficiency.

Would appreciate community feedback , especially if you see any other pertinent risks or benefits worth discussing.