Summary

Should the community choose to onboard PT - USD0++ - 27Nov2025 to the Euler Yield markets, Gauntlet recommends the risk parameters below:

Specifications

| Supply Cap |

Borrow Cap |

| 500K |

NA |

| Collateral |

Debt |

LLTV |

Borrow LTV |

| PT - USD0++ - 27Nov2025 |

USDtb |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

sDAI |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

wM |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDT |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

DAI |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USD0 |

0.84 |

0.82 |

| PT - USD0++ - 27Nov2025 |

RLUSD |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

rUSD |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

PYUSD |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDS |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDC |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDe |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

sUSDS |

0.82 |

0.8 |

Rationale

PT - USD0++ - 26JUN2025 Vault Statistics

- PT - USD0++ - 26JUN2025 vault has a supply cap of 6M with supply cap utilization being ~80%.

- Borrow demand against PT-USD0++ is primarily driven by blue-chip stablecoins with top suppliers using their positions to borrow assets like USDC and USDT. These positions typically maintain health factors just above 1, indicating high utilization and low buffer.

PT - USD0++ - 27Nov2025 Pendle Pool

- Current liquidity is insufficient to support a 1M PT - USD0++ - 27Nov2025 to USD0++ swap, as even a 500K swap results in over 1.5% slippage, indicating significant depth limitations.

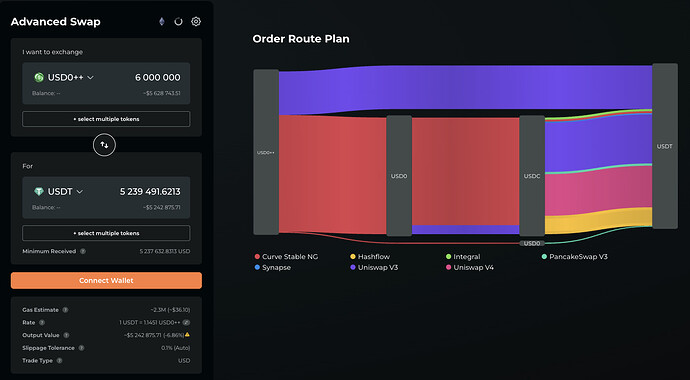

USD0++ DEX Pool Liquidity & Slippage

- As noted earlier, USD0++ relies on a relatively cumbersome atomic redemption process to convert back to USD0. The Floor Price mechanism allows users to redeem USD0++ for USD0 at a discount prior to maturity. This floor is set manually (e.g., 0.87 USD0 per USD0++).

| pool_name |

pool_type |

pool_url |

pool_tvl_usd |

volume_24h_usd |

| USD0++ / USD0 |

curve |

Link |

$67.90M |

$5.45M |

| USD0++ / USDT 0.3% |

uniswap_v3 |

Link |

$897.21K |

$28.05K |

| USD0++ / USDT 0.15% |

uniswap-v4-ethereum |

Link |

$104.25K |

$9.89K |

- The USD0++ ~ USD0 Curve pool is currently the primary source of DEX liquidity. The number of holders in this pool has declined from approximately 6.5K six months ago to around 4K today. With over 60% of the pool size held by Euler vaults, signaling a potential concentration risk.

- PT-USD0++ Euler vaults use Pyth oracles for USD0++/USD market rate pricing and swapping 6M USD0++ now incurs 6-10% slippage, depending on day and time, suggesting liquidity has declined since April, when a similar trade saw ~5% slippage. We also noticed that slippage can reach as high as 15%.

Caps Recommendations

We recommend a supply cap of 500K considering PT-USD0+±26JUN2025 ~ USD0++ slippage limitations.

| Supply Cap |

Borrow Cap |

| 500K |

0 (borrowing disabled) |

LLTV Recommendations

We recommend lowering the LLTV from 84 % to 82 % for PT - USD0++ - 27Nov2025 due to the outlined slippage concerns and concentration risks.

| Collateral |

Debt |

vault_lltv |

vault_borrow_ltv |

| PT - USD0++ - 26JUN2025 |

USDtb |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

sDAI |

0.84 |

0.82 |

| PT- USD0++ - 26JUN2025 |

wM |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

USDT |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

DAI |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

USD0 |

0.9 |

0.84 |

| PT - USD0++ - 26JUN2025 |

RLUSD |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

rUSD |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

PYUSD |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

USDS |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

USDC |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

USDe |

0.84 |

0.82 |

| PT - USD0++ - 26JUN2025 |

sUSDS |

0.84 |

0.82 |

Considering the current liquidity and concentration risk, we recommend reducing LLTV by 2% for PT - USD0++ - 27Nov2025 against other stablecoins.

In addition, we recommend an LLTV of 84% and a borrow LTV of 82% for the PT - USD0++ - 27Nov2025 USD0 pair.

| Collateral |

Debt |

LLTV |

Borrow LTV |

| PT - USD0++ - 27Nov2025 |

USDtb |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

sDAI |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

wM |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDT |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

DAI |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USD0 |

0.84 |

0.82 |

| PT - USD0++ - 27Nov2025 |

RLUSD |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

rUSD |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

PYUSD |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDS |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDC |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

USDe |

0.82 |

0.8 |

| PT - USD0++ - 27Nov2025 |

sUSDS |

0.82 |

0.8 |

Next Steps

- We welcome community feedback.

- We will revisit LLTV settings for Usual.

- We continue to monitor liquidity for PT - USD0++ - 27Nov2025.

Objective Labs: Recommendations for PT-USD0++-27Nov2025 on Euler Yield

Summary

Objective Labs has reviewed Gauntlet’s recommendations for PT-USD0++-27Nov2025. Based on historical volatility risk, present liquidity risk, and the inability to compete with Usual’s superior PT market on Euler, we do not recommend onboarding PT-USD0++-27Nov2025 on Euler Yield at this time.

Volatility Risk

USD0++ is fundamentally different from all other stablecoins in Euler Yield: it is priced as a discounted bond with a floating peg. USD0++ on decentralized exchanges has historically been volatile, less able to benefit from highly concentrated liquidity due to its inherent properties.

Liquidity Risk

Existing DEX liquidity of USD0++ to USDC allows for swaps up to $6M to be executed with <1% slippage with a steep increase beyond that.

USD0++ / USDC Depth

| Size |

Slippage |

| 6M |

1% |

| 8M |

5% |

| 10M |

25% |

PT-USD0++-27Nov2025 / USD0++ Depth

Liquidity in the Pendle market has improved since Gauntlet’s review, serving a $700k swap with <1% slippage and a $4M swap with 5% slippage.

| Size |

Slippage |

| $0.7M |

1% |

| $1.6M |

2% |

| $4M |

5% |

Competitive Risk

Usual is a major user of Euler with the Usual Stability Loan (USL) market nearing $700M in deposiuts and the recently launched PT-USD0++/USD0 market nearing looking to capture PT demand.

We believe Usual’s market is better placed to absorb user demand through fixed borrow rates and protocol-directed liquidity. Therefore we assess that the opportunity to capture borrow demand from Usual’s PTs in Euler Yield is too little to offset the risks added to the marke.t